Prof. Dr. Alexander Mirtchev

Professor Alexander Mirtchev, LLM, PhD is an American academic, executive, and philanthropist, working in the areas of geopolitics, geo-economics, global economic security, political risk analysis, and risk mitigation.

His most recent work, The Prologue: The Alternative Energy Megatrend in the Age of Great Power Competition is available in English, German, Russian, and Spanish.

Dr. Mirtchev is currently a Distinguished Visiting Professor at George Mason University’s Schar School of Government and Policy. He is a founding council member of the Kissinger Institute on China and the United States at the Woodrow Wilson International Center for Scholars, where he was senior fellow and member of the Wilson National Cabinet. Mirtchev is a member of Chatham House and the Royal Institute of International Affairs. He also serves on the James Madison Council of the U.S. Library of Congress.

Mirtchev is a vice chair of the Atlantic Council of the United States, member of the executive and strategy committees, and member of the advisory council of the Scowcroft Center for Strategy and Security. He served as vice president of the Royal United Services Institute for Defense and Security Studies (RUSI), UK, and as executive chairman of RUSI International.

Dr. Mirtchev has authored several monographs and numerous policy articles. He has also served as editor and publisher of academic and professional journals, and was on the Advisory Board of Fox Business’ “Wall Street Week.”

During the course of his business career, Dr. Mirtchev was director of the international business and investment division at Stewart & Stewart, a top-rated Washington, D.C. law firm concentrating on international trade remedy proceedings and WTO negotiations; Chairman of a high-end risk-mitigation services joint venture with a NASDAQ-listed corporation; President and founder of Krull Corp., a macro-economic geopolitical consultancy; Chairman of a Sustainable Development Fund; and Board Member of a Sovereign Wealth Fund; among other notable positions. He also served as president and chairman of several enterprises and is a serial investor in the areas of alternative energy, robotics, artificial intelligence, and other dynamic startup initiatives.

Mirtchev obtained an LLM degree in International and Comparative Law from George Washington University and a PhD in Philosophy from St. Kliment Ohridski University, where he was an associate professor. In addition, he studied economics and finance at the London School of Economics, Boston University, and Harvard Business School. He also received Honorary Doctorates from the Ukrainian Academy of Foreign Trade and several other international academic institutions.

Dr. Mirtchev’s personal interests include classical philosophy, opera, and art. Befittingly, he is the curator of the Hellenistic Tanagra Figurine Educational Initiative.

For additional information on Dr. Alexander Mirtchev visit mirtchev.com.

Mirtchev In The News

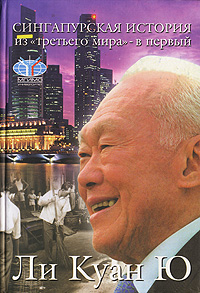

Lee Kuan Yew’s memoirs “From Third World to First: The Singapore Story, 1965-2000” | Foreword by Dr. Henry Kissinger and Introduction by Dr. Alexander Mirtchev

Russian language edition

The Moscow State Institute of International Relations of the Ministry of Foreign Affairs of the Russian Federation (MGIMO) launched its new publishing series with the book “From Third World to First: The Singapore Story, 1965-2000” – the memoirs of the first Prime Minister of Singapore Lee Kuan Yew. Dr. Henry Kissinger noted: “I share with Dr. Mirtchev his great admiration for Minister Mentor Lee, whom I believe to be one of the greatest political leaders of the post-World War II generation.” MORE

Finances on a War Path: The “Weaponization” of Financial Markets as Legitimate Tools of Foreign Policy | By Dr. Alexander Mirtchev

January 29, 2016

Gone are the days when the world was viewed through the lens of Pax Americana; a time when the United States predominantly set the tone and rules of the game. Today, we find ourselves in the midst of a profound long-term global political and economic transformation leading to a radically changed world. MORE

Shale gas – the new best US foreign policy tool? | By Dr. Alexander Mirtchev

November 27, 2013

What are the geo-economic and foreign policy implications and advantages associated with the so-called “shale gas revolution?” The growing significance attached to non-traditional fossil fuel resources is seen as a factor that can remove previous dependencies on external suppliers, the need to protect transport routes and choke points, as well as the need to maintain the security of far-flung territories and countries that are often a source of instability. MORE

Alternative Energy and Global Energy Security In Aftermath Of Rio+20 | By Dr. Alexander Mirtchev

August 27, 2012

The concept of a ‘green economy’ enjoys support among the G20 and was a central theme at Rio+20. This begs a question: If everyone from members of civil society to corporate and government leaders vigorously nod their heads when ‘green’ is mentioned, why doesn’t the issue ever get advanced in a global context? One answer seems to lie in the inability to agree on a definition of what is meant by ‘green economy’ or ‘green growth.’ Another answer stems from the increasing divergence in previously established positions and attitudes that served as bonds among geopolitical alliances, unions and informal groupings. As we have witnesses seen with the EU’s ongoing–and unsuccessful efforts–to devise a unanimously acceptable (or even barely tolerable) scheme to address the euro zone crises, when question of economic security arises, all other considerations fall by the wayside. MORE

Will the G-20 Counter the Power of Uncertainty? | By Dr. Alexander Mirtchev

October 28, 2011

In the run-up to the French G-20 summit, the rising tide of global economic turmoil and problems ranging from sovereign indebtedness to consumption and saving imbalances have created a ‘perfect storm’ that is far from abating. What are the challenges that G-20 leaders face in setting forth a concrete, viable roadmap that genuinely addresses the range of outstanding global economic security risks, and in particular countering the uncertainty gripping the global economy? ….Regarding the sovereign debt crisis, leaders appear to be primarily addressing a symptom – lack of liquidity, rather than the underlying cause – a lack of solvency. MORE

The new EU External Energy Policy: an important move – if it is not too late | By Dr. Alexander Mirtchev

December 8, 2011

With the adoption of its new External Energy Policy, the EU has finally made a first step towards its integration as a single negotiating bloc in the world energy market. As such the External Energy Policy could become an important factor in the global energy security picture and a possible geopolitical game-changer. However, it remains to be seen whether the big EU member states will be willing to subordinate their interests to the wider EU interest. The External Energy Policy has probably come five years too late, argues Alexander Mirtchev, President of Krull Corp. and Vice-President of the Royal United Services Institute for Defence and Security Studies. MORE

Will Financial Regulation Trash Global Economic Security? | By Dr. Alexander Mirtchev

March 29, 2012

Under the auspices of the Financial Stability Board, more than 30 recommendations have been set out as part of a massive and far-reaching G-20 financial regulatory reform package to ostensibly minimize risk in the financial system and maximize consumer protection….Indeed, the call for increased regulation follows in the wake of every major crisis, and no call was made with more ardor than the call for increasingly tight and comprehensive regulation of the financial sector. How will these regulations impact economic growth and global economic security? MORE

We are all Europeans Now | By Dr. Alexander Mirtchev

January 4, 2012

While the EU has modernized and expanded in ways that its founders may not have envisioned, the architecture that underpins the Union has not adapted to the realities of a globalized twenty-first century. In effect, “we are all Europeans now, as the euro zone crisis threatens global economic security and threatens to evolve into a renewed global economic crisis.” Genuinely addressing these threats likely will mean rebuilding Europe from the bottom up and laying the foundation for a new era of European growth. MORE

Gold Prices Struggle to Stay Near $1,700 | By Mike Obel

November 13, 2011

The new streamlined credit line will “probably act as another form of quantitative easing, as the recipient countries would rather address liquidity, instead of the underlying fundamental problem — solvency,” said Alexander Mirtchev, head of Krull Corp. and president of the Royal United Services Institute for Defence and Security Studies International. “By its very nature, the credit line engenders inflationary and other global economic security pressures. It will hardly be the decisive factor, but would contribute to the rise of the price of gold.” MORE

Comment by Dr. Alexander Mirtchev in The Economist

August 31, 2011

In response to the Economist’s debate following Federal Reserve Chairman Bernanke’s speech at the annual meeting of central bankers in Jackson Hole, Wyoming, Mirtchev notes that governments worldwide, including the US Fed, should take a long and hard look at the inflationary impact of the policy responses of the day, i.e., QE3. The majority of measures currently under consideration seem to be of a stop-gap nature, rather than embodying the necessary set of radical reconsiderations aiming to address the structural weaknesses that are imperiling the global economy. MORE

The Times – Letter to the Editor

May 6, 2011

Inflation is a significant factor of global economic security and has the innate capacity to upend carefully laid plans and further upset the efforts to bring the global economy back into equilibrium. In that regard, the risks to recovery associated with higher interest rates should be carefully considered, as ultimately the choice may be between the lesser of two evils: slower recovery or rampant inflation over the longer term. MORE

Sovereign Debt and Beyond: Toward a New Magna Carta? | By Dr. Alexander Mirtchev and Dr. Norman Bailey The Globalist

March 31, 2011

This article is part of the series “The Annals of Entropy: The Search for a New Global Equilibrium”

To what extent is the deteriorating global debt situation undermining efforts to return to sustainable economic growth worldwide? It appears that the debt problems of the developed countries have created an unstoppable momentum, prompting divergent reactions and proposals that are often inadequate to the scale of the problem. On the surface, the policies focus either on austerity measures or further stimulus packages. Both seem to ignore the economic problems that are coming to the surface, in particular in the developed economies. Addressing these problems entails a redefinition of what is essentially the social contract among the government, Main Street and Wall Street, with the current circumstances being a vivid reminder of the precursors of the Magna Carta. MORE

The Global Inflation Wave: Waiting for Emperor Constantine? | By Dr. Alexander Mirtchev and Dr. Norman Bailey

March 24, 2011

This article is part of the series “The Annals of Entropy: The Search for a New Global Equilibrium.”

In the wake of the global economic crisis, the world economy is trying to chart a path to a future equilibrium and find a “new normal.” There is an inherent danger that in the pursuit of recovery and a global economic security equilibrium, inflation has been deemed a target that can be sacrificed. As early in history as the reign of the Roman Emperor Constantine, governments have had to deal with the unsustainable nature of economies, wracked by the problems that inflation imposes. The modern approaches utilized to address economic weaknesses, however, are more reminiscent of Constantine’s predecessor, Diocletian, who undertook price controls and currency debasing policies in order to redress the Roman Empire’s growing liquidity problems. Now, in the US (and Europe) debasement is taking the form of “quantitative easing,” which in turn is supporting a build up toward a surge in prices. MORE

Deep Thoughts by Alexander Mirtchev | By Ashby Monk

November 17, 2010

For a variety of reasons, SWF employees are typically quite reserved and guarded when speaking to the press. Not so for Dr. Alexander Mirtchev, who is the Independent Director and a member of the Board of Directors of Kazakhstan’s $30 billion National Welfare Fund Samruk-Kazyna. Mirtchev has given quite a compelling interview to G20 magazine, and his candor and thoughtfulness sets him apart from his peers. Accordingly, I thought I’d do another ‘deep thoughts by…’ post, which is now becoming a regular segment. Anyway, I want to highlight Mirtchev’s thoughts on investment strategy and risk management, which I found rather interesting. MORE

The Rising Global Significance of Sovereign Wealth Funds – A New Geo-economic and Geopolitical Factor Impacting Global Economic Security

Interview with Dr. Alexander Mirtchev

November 12, 2010

What role do SWFs’ play in the wake of the worldwide financial and economic crisis? Mirtchev assesses the rising economic security relevance of SWFs, noting their historical underpinnings – the VOC (Dutch East India Company), the British East India Company and others. Today, they are taking on a contemporary role as economic power projection tools. The growing relevance and projected significance of SWFs has made them a focal point for more intense scrutiny, and has in turn driven them to increase the level of transparency and accountability that surrounds their investment and operational activities. MORE

Gulf funds may rescue the West | By Tom Arnold

June 26, 2010

The deep pockets of Gulf sovereign wealth funds (SWFs) could be an increasingly important source of funding for western economies facing spending cuts in the new era of austerity. Projects in Europe may become more financially attractive for the region’s government investment vehicles as austerity measures by EU governments depress market valuations, said Dr Alexander Mirtchev, the founder and chairman of the US economic consultancy Krull. “These SWFs are starting to look increasingly as the premier source of available financing for a cash-starved international financial system,” said Dr Mirtchev, who is also an independent director of the Kazakhstan SWF Samruk-Kazyna. “The Gulf SWFs can underwrite the autonomy of states by acting as an insurer of last resort – in other words, a buffer against global crises and cyclical development.” SWFs could become increasingly accepted as investors in the US and Europe, as the spending capacity of western governments remains constrained by the need to cut bulging budget deficits, he said. MORE

![]()

Corporate Finance: Sovereign Wealth Funds Prepare To Take More Active Role In M&A | By Gordon Platt

October 1, 2009

“From the times when kings invested in building pyramids, raising armies and bankrolling explorers, sovereign wealth attracted political controversy,” says Alexander Mirtchev, president of Krull, an advisory and project management firm based in Washington, DC. “But sovereigns have changed with the times and today represent internationally legitimate public authorities,” according to Mirtchev, who is an independent director of Kazakhstan’s SWF, Samruk-Kazyna. “Cooperation among SWFs and their managers on different projects represents a sign of their maturity as investors who have become more aware of the market opportunities,” Mirtchev says. “On certain occasions, it could help funds to become market leaders in specific sectors,” he says. MORE

Emerging Markets: An Interview with Dr. Alexander Mirtchev

Fall 2009, Issue IV, Vol III

Diplomatic Courier: What should rapidly developing economies and emerging markets do in the economic crisis?

Dr. Mirtchev: The recovery of emerging markets and rapidly developing economies itself is likely to be prolonged and patchy, with some industry sectors outpacing others. The commodity-rich economies, for example, ended up owning a lot of overpriced assets through their banks, sovereign wealth funds, and other vehicles. The degree of leverage associated with the funding of a boom and the degree of involvement of their banks and other financial intermediaries has determined the magnitude of balance sheet effects in these countries and their respective actions…. MORE

Cooperation Begets Commercial Success | By Ashby Monk

August 18, 2009

Natsuko Waki of Reuters has a great article out this morning on SWFs working in concert, which is a recurring theme on this site…. While we have looked at these issues at length, Waki still advances our work by securing some elite interview evidence. According to Alexander Mirtchev, the director of Kazakhstan’s SWF: “They [the SWFs] realize that their level of expertise is not universal and find that obtaining additional expertise via cooperation is a viable option for them. They are sharing risk and enabling access to welcome co-financing…In the crisis and post-crisis environment, such cooperation allows them to achieve a new level of legitimacy in markets where they have not operated before…Recent examples of SWFs working together are much more commercially oriented than having any political imperative.” MORE

Sovereign Funds Join Forces for Strategic Investment

August 18, 2009

An increasing number of sovereign wealth funds are working in concert to make joint strategic investments in order to reduce risks and maximize returns, which could provide a stabilizing force in financial markets. State-owned funds from China, Singapore, Malaysia, Korea, Abu Dhabi and Kuwait are among those which have recently signed agreements to form investment partnerships with each other…. “They realize that their level of expertise is not universal and find that obtaining additional expertise via cooperation is a viable option for them. They are sharing risk and enabling access to welcome co-financing,” Alexander Mirtchev, president of Krull Corp., who is also independent director of Kazakhstan’s SWF Samruk-Kazyna, told Reuters. “In the crisis and post-crisis environment, such cooperation allows them to achieve a new level of legitimacy in markets where they have not operated before. SWFs have the potential to stabilize companies they invest in since these funds do not live by quarterly returns.” MORE

After the Worldwide Bailouts – The Long Shadow of Overwhelming Sovereign Indebtedness Has Not Created an Imperative to Redefine the “Social Contract” between Main Street, Wall Street and the Government

May 14, 2009

Dr. Alexander Mirtchev, founder and president of Krull Corporation, discussed the U.S. government’s actions in response to the crisis in the economy on Al-Jazeera’s Riz Khan Show. The complexities created by the precarious economic and financial situation are exacerbated by what is perceived as a “failure of the reigning ‘social contract'” between Main Street, Wall Street and the U.S. government. “To put it simply, Main Street was relying on Wall Street to go about its business, with the government perceived as the arbiter and even guarantor of sure returns. Presently, the collapse of this ‘contract’ is giving rise to calls from different quarters for overhauling the whole system,” according to Dr. Mirtchev. MORE

In the Midst of the Crisis “Bottom Fishing” has Already Begun – Multinationals Navigating the Emerging Multi-centric Global Economy | By Natsuko Waki

April 7, 2009

Sovereign wealth funds, hit hard by ill-timed investments into Western banks, may soon dip their toes back into risky assets with a more focused approach that avoids bargain-seeking for its own sake….”To a large extent the period of ‘withdraw and regroup’ for the SWFs is more or less over. Everybody in the sector would say that the bottom has not been reached yet, but bottom fishing has already started,” Alexander Mirtchev, independent director of Kazakhstan’s SWF Samruk-Kazyna, told Reuters. “It is more than likely that the targets they will choose eventually would have specific strategic significance for their own economies,” said Mirtchev, who is also a senior economic adviser to the Kazakh prime minister. MORE

Emerging Markets’ Uneven Recovery Creating New Strategic Openings – Multinationals in the Midst of the Downturn

February 26, 2009

In an interview with Voice of America television, Dr. Alexander Mirtchev, an economic policy expert and president of Krull Corporation, shed light on the strategic options that multi-national companies have in some rapidly emerging markets during the economic crisis and beyond. Dr. Mirtchev points out that the recovery packages in development by the G7 economies have a direct impact on developing economies, such as China, Brazil, and Russia, as well as on the smaller emerging markets, and the respective measures they are undertaking. “It is now understood that there is no truth to the view that emerging markets are ‘decoupled’ from the global economy — they are facing the same systemic pressures as the rest of the world, and their reaction — which varies from country to country and from industry to industry — is putting paid to the notion that these markets can be bundled and packaged together as ‘the same class of asset’.” MORE

![]()

Burgeoning Sovereign Debt Could Sink Global Economic Stability

Mergermarket Interview

January 11, 2009

Dr. Alexander Mirtchev assesses the implications for government intervention in the banking system in an interview with Mergermarket, a Financial Times company. He notes that the crisis which has led governments to accept the transfer of private sector debt onto state balance sheets exposes both developed and developing economies to sovereign debt and deficit imbalances. Such transfers are likely to have far-reaching repercussions, deepening some economies’ exposure to the impact of the financial crisis and possibly prolonging the advent of recovery, ultimately threatening some of the pillars of global economic security. MORE

![]()

Local Showdown with the Global Downturn – Two Patterns of Dealing with “Toxic Assets” Emerge

January 11, 2009

Alexander Mirtchev, prominent Washington-based economic expert and global strategist, discussed the international economic stabilization plans and steps to jump-start faltering financial institutions in the emerging markets with EuroWeek, a publication that covers the international capital markets. In an exclusive interview granted to this influential professional publication, Dr. Mirtchev explained that some of the rapidly expanding and emerging market economies in the world are better positioned than others to deal with the pressures of the global credit crunch and economic downturn. He believes that in China, India, Brazil, Russia and certain other markets, the implementation of extensive fiscal stabilization tactics, combined with recapitalization, extensive lending provisions and liberalization of reserve requirements can yet insulate the leading banks from the negative pressures of the global financial crisis. MORE

Economic Expert Says the Key to Creating Growth for Multinationals Post-Crisis Is to Focus on Core Business and Expand Their Global Footprint

December 8, 2008

In a recent Reuters interview that was featured in UK’s The Guardian, the founder and president of the Krull Corporation, Dr. Alexander Mirtchev, discussed the impact of the global economic slowdown and the financial crisis on the growth potential of major multinationals, in particular in the emerging markets. “Despite the fact that multinationals generate the majority of their total revenues from developed economies, emerging markets could provide the all-too-necessary upside that may be the difference between success and failure during the crisis, its fallout and, most importantly, in the positioning for recovery,” he said. MORE

Anticipated Post-Crisis Momentum Could Reposition Emerging Markets – States Retooling to Utilize New Geo-Economic Instruments such as SWFs

December 5, 2008

Dr. Alexander Mirtchev discussed strategies used by emerging markets to counter the global crisis and position themselves for recovery. One key strategy is the retooling of their economic arsenals, in particular sovereign wealth funds. Mirtchev believes that the crisis is going to lead governments toward re-tasking SWFs to abandon previous vectors of investments and move towards more tangible profit-driven and productivity-oriented strategies, becoming more and more focused on and sensitive to their governments’ need to react to the economic downturn. MORE

![]()

The Varied Approaches to Tackle the Crisis Converging Around Government Intervention will Create Different Paths to a Patchy and Uneven Recovery

November 28, 2008

Dr. Alexander Mirtchev reviews and compares the crisis-management measures adopted by economies worldwide, as well as the different strategies and specific actions undertaken by a number of developed countries – the US, the UK and other EU economies, as well as certain emerging markets. He asserts that the developed countries’ “recovery strategy of choice” is focused on addressing the banking sector’s liquidity problems rather than the more pertinent solvency problems faced by both the private and public sectors of those economies. MORE

![]()

The “Glamour” Investments Party is Over – SWFs to Reconsider Core and Non-core Assets and Restructure Portfolios

November 21, 2008

Dr. Alexander Mirtchev, President of Krull Corp and a sovereign wealth fund independent director, believes that most of the sovereign wealth funds that gained prominence in the last 5 years will probably need to retool in order to face the challenges that arise out of the global economic and financial crisis. He expects them to shift their focus to productive assets that are related to their base economies, such as natural resources or technologies, and promptly restructure. MORE

![]()

Foreign Exchange Volatility a Concern but “Old-Fashioned Currency Control” Not the Answer

October 31, 2008

The global economic and financial crisis has struck emerging market currencies, yet Dr. Alexander Mirtchev, founder and chairman of the Krull Corporation and a transitional economy expert, believes that central banks in the emerging markets should resist the temptation to restrict currency flows. Despite the volatility in the foreign exchange markets and the negative impact on emerging market currencies, Mirtchev believes that FX restrictions would hinder the prospects of a sustainable recovery. “Maintaining liquidity is an obvious factor in alleviating some of the pressure on the markets,” Mirtchev said, “and any ‘quick-fix’ moves by central banks in rapidly developing economies to restrict currency flows could turn out to be a faux pas. In the short-term, we are seeing losses, but as the markets stabilize, equity and capital investments remain the fastest way to stimulate growth.” MORE

Supply-side Recovery Strategies – National Approaches and Mechanisms Shifting Focus onto Productivity

November 19, 2008

Billed a year ago as saviours of Western capitalism, sovereign wealth funds now look as vulnerable to the credit crunch as anyone else and are witnessing a rapid downgrade to their growth outlook. …. “They are going to face severe restrictions on their operations. They’re going to stop the trend towards … glamour investment and big splash spending,” said Alexander Mirtchev, chairman of the board of directors of Kazakhstan’s SWF Kazyna. Mirtchev, who is also an economic adviser to the Kazakh prime minister, said SWFs were likely to shift their focus on productive assets that are related to their own economies, such as natural resources or technologies, in order to survive. MORE

While Worldwide “Bailout Packages” are Perceived as a “Necessary Evil” there is a Hefty Price to be Paid

October 13, 2008

“One effect of these bailouts that appears unclear is how they will affect emerging markets, which are at present the source of highest economic growth in the world,” said Dr. Mirtchev. “Some emerging markets, such as Korea, Russia and Kazakhstan, that are essentially dollar-based economies, have a pronounced liquidity problem — the local banks, which dominate the market, do not have enough cash to maintain their existing debt obligations, and there are no visible options for obtaining additional external financing. Other emerging markets, such as Brazil, Chile and Argentina, have a more cash-rich banking basis, and the dearth of liquidity will not be so visibly felt for a much longer period — in other words, the period of economic slowdown in these countries would either be prolonged or economic recovery would come much later.” MORE

Beyond the Burgeoning Crisis – The Financial Crisis will be Followed by a Patchy, Uneven and Anemic Recovery

October 11, 2008

In an interview with Reuters, Dr. Alexander Mirtchev, founder and chairman of the Krull Corporation and an economic expert on emerging markets, shared concerns about the impact of the credit squeeze on emerging market economies. As the U.S. financial system continues to bear historic pressure, economies that have experienced considerable growth in the past decade are in grave danger of entering a prolonged period of slowing growth. While the central banks in some nations are better equipped to deal with a liquidity squeeze, dollar-based economies such as Korea, Russia and Kazakhstan will be faced with serious challenges in the coming year. MORE

Global Economic Security Imbalances – Still Inherent in Recovery Strategies of the Leading Economies

October 10, 2008

Dr. Alexander Mirtchev, founder and chairman of the Krull Corporation and an economic expert on emerging markets, sat down with Bloomberg Television in London to discuss the impact of the financial crisis on the economy of Kazakhstan. Overall, Mirtchev said, the crisis “has been treated mainly as a liquidity crisis and I would strongly argue that it is more of a solvency and asset quality crisis.” Dr. Mirtchev, the chairman of Kazakhstan’s national development fund, Kazyna, believes that the economic reforms established in the country include measures to deal with such a crisis. These measures are, he says, “why the crisis is not affecting them to the extent that it is affecting other emerging markets.” MORE

Global Economic Security Rebalancing – Commodities Price Volatility as a Symptom of Upcoming Asymmetric Economic Cycles

September 24, 2008

Emerging market experts, tracking the fluctuating prices, were generally optimistic on the long-term stability of energy-heavy economies such as Russia, Bolivia, Mexico, Kazakhstan. The overall feeling is that the prospect of further massive debt by the U.S. government and the diminishing value of the dollar will further encourage investments in productive assets, including oil. “The nature of the bailout, which appeared to be partially dependent on the political calendar, may have far reaching consequences that were unanticipated by the framers. It remains to be seen whether or not the bailout can bring the fragile financial system back to a state of extended expansion, which is highly doubtful, or, in the financial analysis, would it start addressing the new paradigm of the world financial system that has emerged in the 21st Century,” stated Alexander Mirtchev, chairman of the board of directors of Kazyna, the sustainable development fund of Kazakhstan. MORE

Tomorrow’s Exit Strategy Should be in Place Today

September 20, 2008

Today’s market increases and the announcement by the U.S. government to undertake a major bailout plan to restore confidence in the world financial system, prompted a rare comment from Alexander Mirtchev, Chairman of the Board of Directors for the Kazakhstan Sustainable Development Fund, Kazyna. “There are dire predictions being made about the impending meltdown of emerging markets. The predictions are based on the assumption of a steep decline in commodity prices, combined with a liquidity squeeze that, taken together, will wipe out the reserves of transitional market countries,” said Dr. Mirtchev, who is also the founder of the Washington-based consulting firm Krull Corporation. MORE

Appearances

Bloomberg Interviews Dr. Alexander Mirtchev

September 4, 2014

Dr. Alexander Mirtchev provides his take on the rising tide of challenges to the world order. A confluence of crises in different regions and of varied nature heralds an across-the-board push against or outright rejection of this order. Examples include: the Ukraine crisis, where international relation’s norms based on the Peace of Westphalia have been put to the test and the growth of radicalized extremism. The actions of the so-called Islamic State demonstrate how certain actors are no longer acting within the paradigm of behavior and values that have been espoused by the West. MORE

CNBC Interviews Dr. Alexander Mirtchev

June 19, 2013

While the meeting at Enniskillen resulted in an overarching policy position by the G8, it was not accompanied by much in the way of immediate policy output. Achieving tangible outcomes was not helped by the diverse issues requiring urgent response – the conflict in Syria, trade, tax avoidance, corporate transparency, as well as other concerns such as tackling poverty, fighting terrorism and maintaining the still fragile economic recovery. Achieving consensus was further undermined by the persistent differences in economic security strategies espoused by various G8 countries. Predictably, the outcome was a G8 communiqué sparse on detailed growth measures, evidence that states’ immediate focus is on finding new ways to fill depleted government coffers. MORE

CNBC Interviews Dr. Alexander Mirtchev

June 13, 2013

The summit’s agenda is being shaped by the divergent pressures of political urgency and the need to meet long-term geopolitical and geo-economic necessities. Beyond the immediate foreign policy challenges and conflicts, this agenda is focused on the “hot” issues of the day – global growth, stability and governance. Paradoxically, the dominance of these issues coincided, rather than conflicted, with the societal concerns that usually confront summits of this type – the conduct of multinationals, global trade transparency and tax avoidance. This confluence underlined the consistent pressure on leading economies to find new ways to replenish their treasuries, while at the same time revitalize a persistently moribund global economy. The G8 will need to give due consideration to the impact that the increasing attractiveness of geo-economic statecraft actions can lead to new threats to global economic security. MORE

BBC World News Interviews Dr. Alexander Mirtchev

April 4, 2013

The latest step in worldwide quantitative easing measures was undertaken by Japan, which broke away from years of financial discipline. Japan’s central bank – the Bank of Japan – announced an unprecedented stimulus package of $1.4 trillion over 10 years. Monetary easing is affects the perception of the world markets about the willingness of major economies to be part of a global recovery. “The Bank of Japan’s monetary easing should be viewed as a bold political statement, rather than a set of policies that still need to be tested before assessing how they will be implemented in practice and what they will mean.” MORE

The Euro is First and Foremost a Political Project – Intrinsic Political Considerations will not Allow the Collapse of the Euro Zone, For Now

May 11, 2010

Dr. Alexander Mirtchev, President of Krull Corp., in discussion with Dr. Yannis Papantoniou, former Finance Minister of Greece, assessed the survival of the single European currency. The fate of the euro is determined more by the political nature of the European project and the vested political interests behind its survival than by the economic fallout caused by some of the Eurozone’s unstable and debt-ridden economies. The Euro will survive, but, in the long-term it must be supported by sound economic leadership and policies, not the emotional rhetoric from which it was born. MORE

In Reuter’s Interview, Krull Corporation’s Alexander Mirtchev Discusses the Growing Trend of Sovereign Wealth Funds Cooperating in the Wake of the Global Economic Crisis

ABC Channel 25

August 27, 2009

International economist Dr. Alexander Mirtchev, president and founder of the global strategic solutions provider Krull Corporation, considers sovereign wealth funds to be a potent, but “less visible” factor for growth in the world economy. In an interview with Reuters, Mirtchev noted that….”Sovereign wealth funds have already moved beyond the ‘withdraw and regroup’ stage brought about by the crisis, not to mention the time of the ‘glamour investment’ that is now over, as they face the need to prioritize their portfolios and focus on new areas of growth, which underlies the rationale for joining forces on an ad hoc basis,” according to Dr. Mirtchev. MORE

Rectifying the Discordant Role of the International Financial System in the Global Security Architecture – Time to Unleash a Global “Financial Mega-Market?”

Al Jazeera Interview

June 2, 2009

The President of Krull Corp. Dr. Alexander Mirtchev believes that the initiatives espoused to reform the global financial markets and reshape regulations ultimately represent an attempt to “put the genie back in the bottle.” To an extent, the regulatory drive is reminiscent of an effort to bring the global financial system back to its pre-crisis status, rather than reform it. MORE

The Omnipresent Specter of Sovereign Debt – Defining the Nature of the Post-Recovery Period and Beyond

Al Jazeera Interview

May 24, 2009

Dr. Alexander Mirtchev, President of Washington, D.C.-based Krull Corp., assesses the short- and long-term implications of policies, in particular in the U.S., undertaken to counter the recession. Intensive government intervention in the private sector and financial markets has brought to the surface a range of issues likely to impact the restoration of the “social contract” between Main Street, Wall Street and the government. The “elephant in the room” – the specter of stagflation, economic depression and incipient inflation – is also a factor that can exacerbate the wider economic impact of worsening sovereign debt. MORE

![]()

The Global Economic Security Equation – Likely Prospects Defined by Worldwide State Intervention in the Markets and Resulting Accumulated Debt

MSNBC

May 11, 2009

Dr. Alexander Mirtchev, president of Washington, D.C.-based Krull Corporation, discusses the path to recovery from the global downturn on Al-Jazeera’s “Riz Khan Show.” He emphasizes that the sporadic signs of optimism and “green shoots of recovery” should not be taken as proof positive that a speedy rebound is just around the corner. MORE

![]()

Liquidity vs. Solvency – A Choice with Profound Implications for Dealing with the Crisis and the Recovery Period, and, Most Importantly, for Post-Crisis Global Economic Security

MSNBC

February 19, 2009

In an interview with Voice of America television, Dr. Alexander Mirtchev, a prominent economic policy practitioner and president of Krull Corporation, answered questions about the challenges faced by the governments worldwide in dealing with the financial crisis and the economic downturn. He offered his comparative analysis of rescue options and current measures available to the governments of the U.S. and other G-7 economies and the large emerging markets such as Russia, Brazil and China. “Even though the greatest focus has been on the U.S. and other developed economies, the financial crisis and the concurrent steep economic downturn that are mutually interlinked and reinforcing each other, are a global phenomenon,” indicated Mirtchev. MORE

Globalization and Fragmentation as Two Sides of the Same Coin

Bloomberg Television Interview

February 12, 2009

The President of Krull Corp., Dr. Alexander Mirtchev, assessed the strategies of emerging markets and banks in those markets which are being used to deal with the credit crisis and the global economic slump. He indicated that while the banks will accept government assistance, they are not in a position to fully utilize the resources received before needing to find a market solution to their difficulties. MORE

Global Economic Adjustment Seems Inevitable

Voice of America Interview

January 22, 2009

The President of Krull Corp., Dr. Alexander Mirtchev, analyzes the potential growth strategies of multinationals faced with the vagaries of the global financial and economic crisis, as a feature of the upcoming global economic adjustment. Following the impact of across-the-board government intervention, emerging markets represent an area of growing interest, due to the relative abundance of undervalued assets that have remained undeveloped due to the crisis. Mirtchev’s view is that these markets not only provide greater upside potential for multinationals, but also could significantly enhance their global positioning. MORE

Energy Expert Tells Viewers That the World Confronts a New Paradigm When Addressing Energy Policy with Russia

E&E News

January 17, 2009

As Russia and Ukraine continue their disagreement over natural gas pricing and shipments to Europe, Russia’s growing assertiveness in the region is becoming very apparent. Alexander Mirtchev, founder and president of Krull Corporation discussed with Energy and Environment Television how the Russia-Ukraine natural gas relationship affects European and American foreign and energy policies and what does Russia’s growing influence in the energy sector mean for the United States, as well as the underlying factors, determining the unmanageability in the long run of the Russia-Ukraine natural gas relations in its present iteration and explained why Europe is likely to face ongoing supply disruptions, providing no coherent arrangements, reflecting the new XXI century realities, are established. MORE

The Lasting Impact of the Post-Cold War Paradigm Shift on Energy Security

E&ETV Interview

January 15, 2009

Krull Corp.’s President Dr. Alexander Mirtchev, in an interview with Energy and Environment Television, analyzes the tilt in international energy security balances in the context of the transformational geopolitical and geo-economic changes after the end of the Cold War. The Russia-Ukraine gas dispute is a case in point. Mirtchev believes that it is not realistic to expect that energy suppliers like Russia would readily give up the geopolitical competitive advantage endowed by controlling energy resources. MORE

The New G20 “G”-ometry

Voice of America

December 20, 2008

In an interview with Voice of America television, Dr. Alexander Mirtchev, President of Krull Corp., analyzed the implications of government intervention in the markets in response to the challenges of the financial crisis and the economic downturn. The measures that have been announced via international platforms, such as the G8 and G20, reflect the changing G-ometry of the world. MORE

While No Place for Inordinate Energy Security Concerns – Volatile Energy Markets are Here to Stay

Focus Washington Interview

October 13, 2008

Krull Corp. President Dr. Alexander Mirtchev assesses the effect of the dramatic fluctuations in oil and other commodity prices in the context of the financial crisis, indicating that global energy balances would be affected in the long run. Policymakers should consider a comprehensive and coordinated strategy for engaging the key supplier and consumer emerging markets and making them feel they have a stake in resolving global energy issues. Such a strategy, coupled with diversification of supply channels and production capacities, would need to be put in place and take effect in the near future, in order to effectively address global energy security imbalances. MORE

Liquidity vs. Solvency – Prioritizing Liquidity Over Solvency will Determine Anti-Crisis Policies and Define the End-Game

Bloomberg TV Interview

October 4, 2008

Dr. Alexander Mirtchev analyzes the varied responses to the current financial crisis on Bloomberg Television. Mirtchev considers the crisis to be more of a solvency and asset quality crisis rather than a liquidity crisis, and that government intervention in the markets by several countries ignores this issue at the peril of a number of unanticipated results in the ultimate end game post-crisis. MORE

The Worldwide Bailout Plans – A “Universal Cure Of Choice”?

Focus Washington

September 10, 2008

Dr. Alexander Mirtchev, President of Krull Corp., believes that the U.S. bailout plan already represents the embodiment of an inevitable universal “cure of choice” across the globe. His perspective on the current economic situation, both in the U.S. and in both the developed and emerging markets, is that the reaction of the developed economies’ governments to the credit crunch represents a “bad choice from a plethora of bad choices.” MORE